No April Fool’s jokes this year.

What is normal? As we work through this black swan event, you’ve doubtlessly heard reference to “the new normal”. What does that mean?

Normal derives from norma in Latin, a carpenter’s square, and means something expected, usual, or standard. One of the challenges we’ll all have in the weeks and months to come is what normal looks like in our data and analytics. Many of the external metrics we’ve come to rely on have astonishing anomalies in them due to the crisis, from unemployment to public health to everyday business metrics.

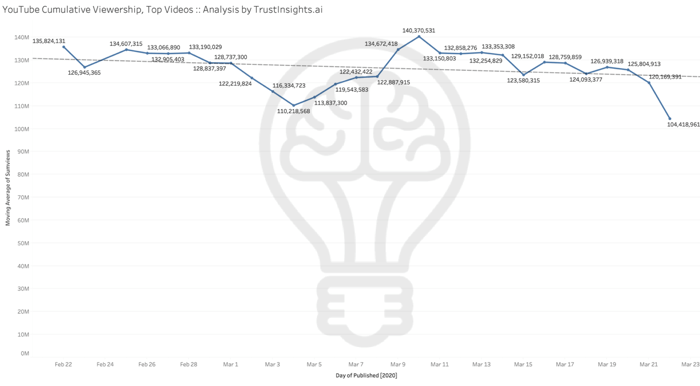

Finding normal means understanding what our data should look like, and for that we turn to basic statistics, to measures of central tendency such as averages and medians. When these two measures are close to each other, things are very normal. When they’re substantially different, something unusual is happening. You could run a very successful campaign, and for a little while they’d be quite different.

For example, let’s take weekly unemployment claims from the Department of Labor. We had a record-setting 3.28 million claims last week, more than 10x the previous “normal”. What does the new normal look like? If you use an average over the last 12 weeks, you’ll see that outlier drag the average up substantially. If you use a median over the last 12 weeks, not much will have changed. These two measures of central tendency will be out of sync for a while.

Over time, both will swing upward if unemployment claims remain high. We’ll know we’re at the “new normal” when both are in sync again.

Think about how this applies to your marketing metrics. How long do you measure trends? Google Analytics and Google Data Studio default to a 28 day view, for example. Email marketing software tends to look at a 12-week view. Measure the median and average of your key marketing metrics over whatever period you usually use, and when both median and average are in sync with each other again, you’ll probably be at the “new normal”. In this week’s Bright Idea, you’ll see a walkthrough exercise for how to do this.

The new normal takes time to achieve, so start monitoring your analytics today to determine where your company’s marketing is.

This week’s Bright Idea is an explanation video of how to find the ‘new normal’ through measures of central tendency. Averages and medians can give us clear direction about which direction any metric, any data series is going. Watch the video along with the spreadsheet software of your choice to learn how to apply this tactic to your data.

Are you subscribed to our YouTube channel? If not, click/tap here to subscribe!

This week’s Rear View Mirror looks at content republishing. In December 2019, we benchmarked content republishing at a median of 4.1% of all articles published were recycled, republished. How much content was republished in March 2020?

The median amount of content republishing in March 2020? 9.03% – more than double December 2019. Why so high compared to last year, especially when December is traditionally a time of heavy content recycling? The answer, of course, is current events – the pandemic. With production of nearly every media and publication disrupted and significantly changed, from late night talk show hosts doing their shows from their houses to furloughed publications, it’s no surprise that media outlets chose to ramp up republishing as a gap-filler while they adjusted operations.

Methodology: Trust Insights used the AHREFS SEO tool to examine 27,223,201 pages published in March 2020 including pages previously published at an earlier date, using the top 25 English language stopwords as selection criteria. Due to the selection method, there is a bias towards English language content in the data. The date of the study period is March 1-31, 2020. The date of extraction is April 1, 2020. Trust Insights is the sole sponsor of the study and neither gave nor received compensation for data used, beyond applicable service fees to software vendors, and declares no competing interests.

- {PODCAST} In-Ear Insights: Finding Product Market Fit

- The Great Shutdown via Why it’s Not a Great Recession or Depression

- Business Analytics 101: How To Monitor Business Trends

- How Many People Watch Instagram Stories Daily? The Latest Research

- Quarterly Predictive Calendars

- Proving Social Media ROI at SMMW20

Shiny Objects is a roundup of the best content you and others have written and shared in the last week.

Data Science and AI

- How AI Tools Dropped One Agencys Reporting Time by 97%

- How To Move a Column to First Position in Pandas DataFrame? via Python and R Tips

- Watch these spring breakers phone signals disperse across the US BGR

SEO, Google, and Paid Media

- How to Improve Page Speed from Start to Finish (Advanced Guide)

- What is speakable schema markup and how does it impact the future of SEO?

- Tricks Some Marketers Use to Fake Authority via Search Engine Journal

Social Media Marketing

- How to Use Social Media in Healthcare: A Guide for Health Professionals

- How Enterprise Social Media Affects the Social Connectivity of Globally Dispersed Workers via Institute for Public Relations

- Facebook updates tools to give users more insight about how it uses data

Content Marketing

- How to Reach Your Content Marketing Goals With Long-Form Content

- Which Content Marketers Will Do Well in the Post-Shutdown World?

- People are listening to less podcasts, potentially due to less commuting

Featured Partners

Our Featured Partners are companies we work with and promote because we love their stuff. If you’ve ever wondered how we do what we do behind the scenes, chances are we use the tools and skills of one of our partners to do it.

- Hubspot CRM

- StackAdapt Display Advertising

- Agorapulse Social Media Publishing

- WP Engine WordPress Hosting

- Techsmith Camtasia and Snagit Media Editing

- Talkwalker Media Monitoring

- Our recommended media production gear on Amazon

Join the Club

Are you a member of our free Slack group, Analytics for Marketers? Join 800+ like-minded marketers who care about data and measuring their success. Membership is free – join today.

Upcoming Events

Where can you find us in person?

- Women in Analytics, August 2020, Columbus, OH

- ContentTech Summit, August 2020, San Diego, CA

- INBOUND 2020, August 2020, Boston, MA

- MarTech East, October 2020, Boston, MA

- HELLO Conference, October 2020, New Jersey

- MadConNYC, December 2020, New York City

Going to a conference we should know about? Reach out!

Want some private training at your company? Ask us!

In Your Ears

Would you rather listen to our content? Follow the Trust Insights show, In-Ear Insights in the podcast listening software of your choice:

- In-Ear Insights on Apple Podcasts

- In-Ear Insights on Google Podcasts

- In-Ear Insights on all other podcasting software

Stay In Touch

Where do you spend your time online? Chances are, we’re there too, and would enjoy sharing with you. Here’s where we are – see you there?

Required FTC Disclosures

Events with links have purchased sponsorships in this newsletter and as a result, Trust Insights receives financial compensation for promoting them.

Trust Insights maintains business partnerships with companies including, but not limited to, IBM, Talkwalker, Zignal Labs, Agorapulse, and others. All Featured Partners are affiliate links for which we receive financial compensation. While links shared from partners are not explicit endorsements, nor do they directly financially benefit Trust Insights, a commercial relationship exists for which we may receive indirect financial benefit.

Conclusion

Thanks for subscribing and supporting us. Let us know if you want to see something different or have any feedback for us!